The U.S. travel industry is dynamic, customer focused, and financially complex. Travel agencies, tour operators, corporate travel management firms, cruise planners, and hospitality coordinators manage thousands of transactions daily. These include customer payments, airline settlements, hotel bookings, vendor commissions, refunds, promotional credits, and operational expenses. In this environment, maintaining financial accuracy is not optional. It is essential for profitability and compliance.

Remote bookkeeping services provide travel companies with a structured and technology driven approach to financial management. By leveraging secure cloud platforms and professional accounting expertise, travel businesses gain consistent oversight of their financial operations without the burden of maintaining large in house teams.

As digital booking platforms expand and customer expectations rise, financial operations must evolve alongside them. Remote bookkeeping enables travel organizations to centralize data, reduce errors, and gain real time visibility into performance metrics that drive strategic decisions.

Financial Challenges in the Travel Industry

Travel companies face unique financial challenges. Revenue flows through multiple channels such as direct bookings, online travel agencies, global distribution systems, and corporate contracts. Each channel may have different commission structures, payment cycles, and reporting requirements.

Seasonality adds another layer of complexity. During peak travel periods, transaction volumes increase dramatically. Off peak seasons require tighter cost control and careful cash flow monitoring. Inconsistent bookkeeping during high volume periods can result in reporting delays and reconciliation issues.

Remote bookkeeping services help standardize financial workflows. Professional bookkeepers ensure that every transaction is recorded accurately, categorized correctly, and reconciled promptly. This consistency reduces financial discrepancies and strengthens operational confidence.

What Remote Bookkeeping Services Cover

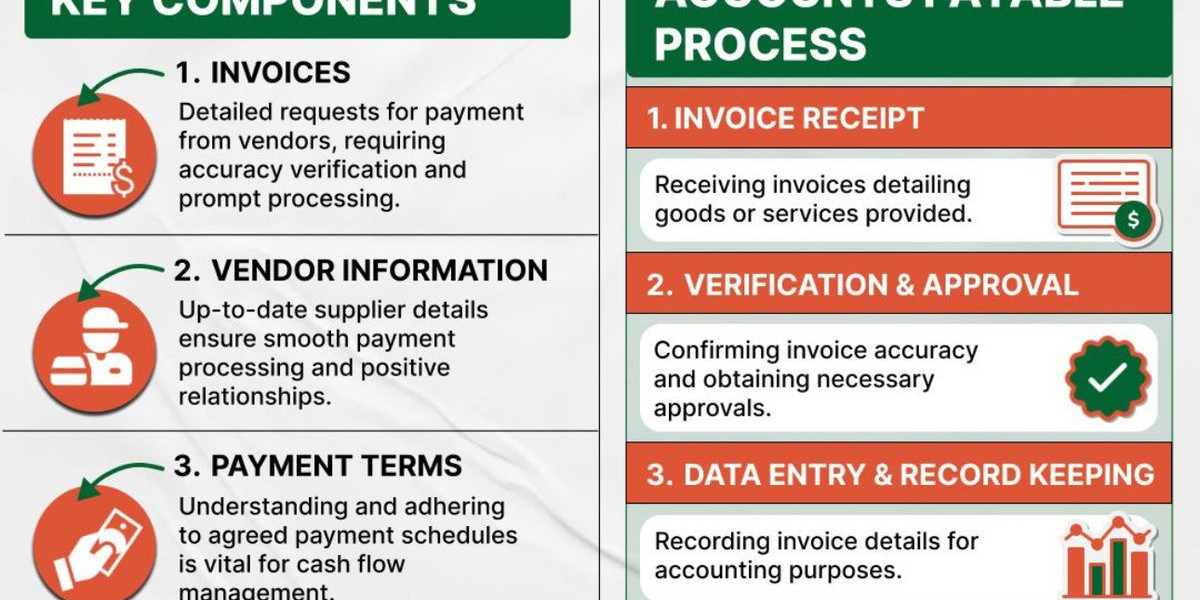

Remote bookkeeping involves much more than basic data entry. It encompasses full cycle financial management tailored to the travel industry. Services typically include transaction recording, accounts payable and receivable oversight, commission tracking, bank reconciliation, expense management, and structured financial reporting.

Instead of maintaining physical records or fragmented spreadsheets, travel companies can access secure digital dashboards that display real time financial insights. These insights support budgeting, forecasting, and vendor negotiations.

By outsourcing to experienced professionals, organizations ensure compliance with accounting standards and internal financial policies. This improves accuracy while reducing the administrative strain on internal teams.

Technology Advancements in the Past Year

Over the past six to twelve months, travel businesses have accelerated their adoption of cloud accounting platforms and automation tools. Real time integration between booking systems and accounting software has become increasingly common. These integrations reduce manual reconciliation work and improve transaction accuracy.

Automation now assists with expense categorization and anomaly detection, helping businesses identify irregular financial patterns more quickly. According to research from the <a href="https://www.ustravel.org/research">U.S. Travel Association</a>, digital modernization remains a primary driver of operational efficiency across the travel sector. This ongoing transformation highlights the importance of scalable remote bookkeeping services that align with advanced financial technologies.

Additionally, regulatory scrutiny around financial transparency continues to increase. Travel businesses must maintain organized documentation to support audits and tax compliance. Remote bookkeeping provides consistent record keeping that aligns with modern compliance expectations.

Strategic Advantages of Remote Bookkeeping

One of the most significant advantages of remote bookkeeping services is scalability. Travel companies can expand operations across states or internationally without restructuring their internal accounting departments. External bookkeeping teams adjust resources based on workload and seasonal demand.

Cost efficiency is another major benefit. Instead of hiring and training additional staff, companies gain access to experienced professionals through a flexible outsourcing model. This approach reduces overhead while maintaining high standards of accuracy.

Remote bookkeeping also enhances financial visibility. Leadership teams can review revenue performance, vendor expenses, and cash flow status in real time. This transparency supports faster decision making and improved strategic planning.

Strengthening Compliance and Internal Controls

Compliance plays a central role in financial management for U.S. travel companies. Accurate bookkeeping supports tax reporting, vendor audits, and financial transparency. Inconsistent records can lead to penalties, disputes, or reputational damage.

Remote bookkeeping services ensure structured documentation and consistent reporting formats. Detailed reconciliation processes reduce the risk of discrepancies. Organized financial records improve audit readiness and enhance credibility with partners and investors.

By embedding professional bookkeeping practices into daily operations, travel organizations build stronger internal controls and reduce financial risk exposure.

Solutions IBN Technologies Provides

IBN Technologies delivers secure and scalable remote bookkeeping services tailored to the needs of U.S. travel companies. Their solutions include

- Comprehensive transaction recording and ledger management

- Accounts payable and receivable monitoring

- Commission and vendor reconciliation support

- Financial reporting and documentation management

These services are delivered through secure digital systems that prioritize accuracy and confidentiality.

Benefits of Partnering with IBN Technologies

Travel companies partnering with IBN Technologies gain

- Improved financial transparency and reporting consistency

- Reduced administrative workload

- Enhanced compliance support

- Scalable bookkeeping aligned with seasonal demand

- Access to experienced financial professionals

These benefits contribute to stronger financial governance and long term operational stability.

Long Term Value for Travel Businesses

Remote bookkeeping extends beyond day to day accounting. Reliable financial data enables accurate forecasting and strategic planning. Travel companies can identify profitable service lines, manage vendor relationships effectively, and allocate resources based on performance insights.

As the industry continues to evolve through digital platforms and customer centric innovation, structured financial management becomes even more critical. Remote bookkeeping services provide the foundation for sustained growth and resilience.

Conclusion

The U.S. travel industry requires precision, adaptability, and financial transparency to remain competitive. Remote bookkeeping services offer a secure and efficient solution for managing complex accounting operations while supporting scalability and compliance.

By combining professional expertise with advanced digital tools, travel companies gain financial clarity and operational confidence. Investing in structured remote bookkeeping strengthens internal controls, enhances reporting accuracy, and positions organizations for long term success in a rapidly changing marketplace.

About IBN Technologies

IBN Technologies LLC is a global outsourcing and technology partner with over 26 years of experience, serving clients across the United States, United Kingdom, Middle East, and India. With a strong focus on Cybersecurity and Cloud Services, IBN Tech empowers organizations to secure, scale, and modernize their digital infrastructure. Its cloud portfolio includes multi cloud consulting and migration, managed cloud and security services, business continuity and disaster recovery, and DevSecOps implementation enabling seamless digital transformation and operational resilience.

Complementing its technology driven offerings, IBN Technologies also delivers Finance and Accounting services such as bookkeeping, tax return preparation, payroll, and AP AR management. These services are enhanced with intelligent automation solutions including AP AR automation, RPA, and workflow automation to drive accuracy and efficiency. Its BPO services support industries such as construction, real estate, and retail with specialized offerings including construction documentation, middle and back office support, and data entry services.

Certified with ISO 9001:2015 | 20000 1:2018 | 27001:2022, IBN Technologies is a trusted partner for businesses seeking secure, scalable, and future ready solutions.